A conversation about SERPs with ‘Jim,’ CEO of a $1.5 billion credit union.

For over a decade, I’ve talked with credit union leaders about their financial futures, retirement and how supplemental executive retirement plans could help them.

In every one of these conversations, a key message comes through: Thoroughness when considering retirement income projections isn’t just a strategy—it’s a financial lifeline.

To explain the importance of thoroughness, I’ve written this fictitious conversation with “Jim,” CEO of a credit union with more than $1.5 billion in assets, based on my conversations with many executives and board members. It’s my hope that this approach will help you understand key information and ideas about the complexities of retirement planning in general and SERPs in particular—information that I think every credit union executive and board member needs to know.

Understanding SERPs

The corner conference room was quiet as Jim leaned forward, ready to continue our conversation about the intricate topic of executive retirement planning that we’d started at a conference the previous month.

“Chris,” Jim began, “let’s start at the beginning. What is a SERP and why would I want one?”

“A SERP,” I explained, “is a supplemental retirement plan that sits on top of the existing employee benefits that may be made available to top-level executives which are meant to both retain them and/or reward their performance.”

“Split-dollar SERPs, in particular, are based on a life insurance policy the executive owns, but the credit union has a lien against, just like a mortgage,” I continued. “Depending on the design, the credit union starts accruing interest on the loan to fund the plan either at the very beginning or a point prior to all the premiums being funded. When funded with whole life insurance policies, the cash value of the split-dollar plan is guaranteed to increase every year.

“At PARC Street Partners, we don’t write split-dollar SERPs based on indexed universal life insurance because of the unique risks associated with IUL. These include sequence of returns risk as well as the lack of guarantees related to the cap rate the insurance company offers. Volatility of the index returns must be considered in the design of these plans. When taking into account any years of bear market, split-dollar plans with IUL are typically risky enough that they’re a mismatch for the risk tolerances of executives and their boards. After all, who wants to get to retirement and find out they don’t have the money to support the lifestyle they thought they’d have in those golden years of life?” When the risks of the IUL are fully understood by the executive and credit union both, they almost always choose the whole life solution.

Understanding Thorough Projections

“I see,” Jim said. “I’m a numbers guy. Can you walk me through retirement projections? What am I missing?”

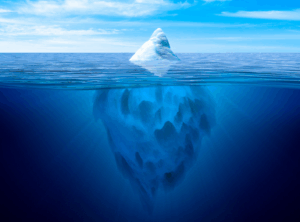

I smiled. “Let’s talk about being thorough in your retirement planning. Only when you’re thorough can you ensure your plan risk matches your risk tolerance–so you can feel assured the plan will pay out as expected at retirement.

“Thorough projections,” I continued, “involve estimating future income and expenses with meticulous caution. This means considering scenarios that include lower-than-expected investment returns, higher-than-expected inflation rates and hyper-realistic assessments of spending.

“The goal is creating a financial plan that matches your risk appetite while protecting against potential shortfalls.”

The Risks of Overly Optimistic Planning

“Let me ask you something,” I continued. “What do you think happens when executives rely only on best-case scenarios of the retirement payout of their plans?”

Jim leaned back. “Based on my experience with credit union financial planning—in which we consider multiple scenarios—I’m guessing nothing good.”

“Precisely,” I said. “Three critical risks emerge when planning isn’t thorough:

Inadequate Funding: Assume your SERP will yield 8% returns, but you only see 5%. That’s a substantial funding gap.

Faster Fund Depletion: Many planners underestimate living expenses, healthcare costs, and inflation. Your savings can evaporate faster than anticipated when your expenses are higher than projected.

Emotional Stress: When reality diverges from projections, you’re left with anxiety that can dramatically impact your retirement quality of life.”

Benefits of Thorough Projections

Jim’s eyes narrowed. “So how do thorough projections help?”

“They have four key advantages,” I responded:

- Enhanced Financial Security: By assuming lower returns and higher expenses, you build a robust financial cushion. Market volatility? Health emergencies? You’re prepared.

- Realistic Goal-Setting: Thorough estimates encourage pragmatic financial goals. You’ll understand exactly how much you need to save.

- Increased Flexibility: Thorough plans create adaptability. If returns exceed projections, you enjoy additional savings without pressure.

Informed Decision-Making: This approach demands comprehensive research, leading to strategic choices aligned with long-term objectives.”

Implementing Thorough Projections in SERPs

“Jim,” I said, “for executives like yourself considering SERPs, implementation requires four critical steps:

Comprehensive Financial Assessment: Here you conduct a detailed analysis of your current financial landscape—assets, liabilities, income, and expenses.

Scenario Analysis: Next, you evaluate multiple market scenarios so you understand potential risks across different financial landscapes.

Regular Reviews: Since retirement planning isn’t static, you’ll need to consistently review and adjust projections based on economic conditions and personal circumstances.

Professional Guidance: I can’t emphasize enough the importance of working with specialized financial advisors who understand executive-level retirement strategies.”

Jim sat back, processing all of this information. “This sounds like a lot of work.”

“It is,” I acknowledged. “But in an ever-changing economic environment, thoroughness isn’t just recommended—it’s essential.”

As our meeting concluded, Jim understood something profound: In retirement planning, thoroughness isn’t just a virtue. It’s a necessity. By embracing a thorough approach, executives can transform financial uncertainty into strategic confidence.

The key isn’t predicting the future perfectly. It’s preparing thoroughly for whatever that future might hold.

We’d be delighted to help you sort through the options.

CRN202711-7623944

About the Author

Chris J. Jones, CLU®, ChFC®

Partner & Senior Benefits Consultant

Known for his analytical mindset and mathematical precision, Chris works closely with credit unions to design Supplemental Executive Retirement Plans (SERPs) that are not only durable and compliant but also grounded in data that supports long-term performance. With more than three decades in financial services, he has built a reputation for ensuring that every plan rests on solid numbers and delivers on its promise to executives and boards.

Since 2014, Chris and his team have implemented more than 200 split-dollar SERPs for credit unions and nonprofits, each one on track or exceeding its original performance projections.