Why some SERPs fail to deliver and how executives can protect themselves from avoidable retirement surprises.

Have you ever gotten a letter telling you that your split-dollar Supplemental Executive Retirement Plan—a special retirement plan put in place to attract or reward key leaders—isn’t going to pay out as projected?

I hope you haven’t. No one wants a SERP to fail to deliver as planned.

But, sadly, some executives in our industry have received this kind of bad news letter about their split-dollar SERP, reading something like this:

Dear Credit Union CEO/C-Suite Member/VP:

Unfortunately, because of the performance of the insurance product that’s the basis of your Supplemental Executive Retirement Plan, your benefit will be 50% lower than we projected.

Instead of receiving $100,000 annually in retirement, you will get $50,000. We recognize that you are only a few years away from retirement, and this will be problematic for you.

We’re sorry.

Sincerely,

Your SERP Provider

Nothing upsets me more than to hear that an executive is facing such an outcome from their SERP, especially because it can be avoided with accurate plan projections, thoughtful plan design, and appropriate action based on the findings of annual reviews.

Take 2020, when the applicable federal rate was 1%. Annual reviews completed that year showed it was a great time to refinance your split-dollar plan to ensure you would meet the original targeted benefit. Did your provider do that? Our firm did.

I’m on a mission to help leaders like you set up SERPs that deliver on their promise so you can enjoy your retirement as planned.

This article will answer three key questions about SERP bad news letters that none of our clients have received:

- Why have some leaders in our industry gotten bad news letters?

- What can you do to avoid getting a letter like this?

- What should you do if you have received a letter like this?

Here’s Why Most ‘Bad News’ Letters Come to Those With Indexed Universal Life-Based SERPs

Let me give you some more detail about how split-dollar SERPs work generally before I get into why SERPs based on indexed universal life (IUL) insurance are more likely to fail than SERPs based on whole life insurance.

SERPs are an agreement between you as the executive and your employing credit union to share the costs and benefits of a permanent life insurance policy, which generally covers you for the rest of your life and pays out regardless of when you die.

With a split-dollar SERP, you, as the executive, own the life insurance policy. To pay for the policy, the credit union makes you a loan, establishing the interest rate at the time the plan is set up. Using the proceeds of the loan, you make the first premium payment and prefund the remaining payments in a “prefunding vehicle,” typically an annuity or a premium deposit account. To make the agreement fair for both the credit union and you, the executive, you give your credit union employer an interest in the policy’s death benefit and cash value.

The type of life insurance used as the basis for the plan matters too. Using IUL insurance as the basis for the plan creates considerably more uncertainty than using whole life insurance.

It’s true that whole life SERPs can underperform original benefit projections. To be successful, whole life SERPs need to be designed with a downside buffer, just in case. We build such a buffer into every one of our SERPs by using a lower dividend rate than the current one in our calculations.

When a split-dollar SERP is funded with whole life insurance, the cash value of the plan is guaranteed to increase every year. In contrast, when a split-dollar SERP is funded with indexed universal life insurance, the plan faces significant additional risks, the most key being:

- QThe lack of guarantees related to the cap rate the insurance company sets annually

- Q“Sequence of returns” risk

- QThe sheer complexity of the plan

We’ll look at these three risks in a moment. But first, let’s talk a little more about the likelihood of success and failure of SERPs built with whole life insurance.

As previously shared, poorly designed SERPs built on whole life can also fail to deliver the originally projected retirement benefit. We’ve already talked about the importance of building a downside buffer into every whole life SERP. Did your SERP provider follow the same philosophy in designing your current plan? If you don’t know, I urge you to ask!

In addition, whole life-based SERPs don’t carry the inherent risks of those based on IUL, making them less likely to deliver a retirement benefit that’s smaller than projected. For example, the dividend from a whole life policy can vary year to year but only by a small amount, so “sequence of returns risk,” which we’ll discuss in detail momentarily, doesn’t apply.

Plus, as noted earlier, the cash value of the policy is guaranteed to go up year after year. In all, building a SERP with whole life insurance creates a more durable SERP.

The Risks of SERPs Built on Indexed Universal Life Insurance

To explain why IUL SERPs are more likely to fail, sometimes causing executives to get a bad news letter from their SERP provider, let’s discuss each of the three key risks of IUL-based plans in more detail.

SIGNIFICANT RISK #2: SEQUENCE OF RETURNS

With an IUL-based split-dollar SERP, the insurance company sets an annual maximum cap—or limit—on what the plan can earn, tying it to an underlying index like the S&P 500. So, for a principal amount of $100,000 with a cap of 8%, the index credit to the plan is limited to $8,000, even if the index does better than 8%.

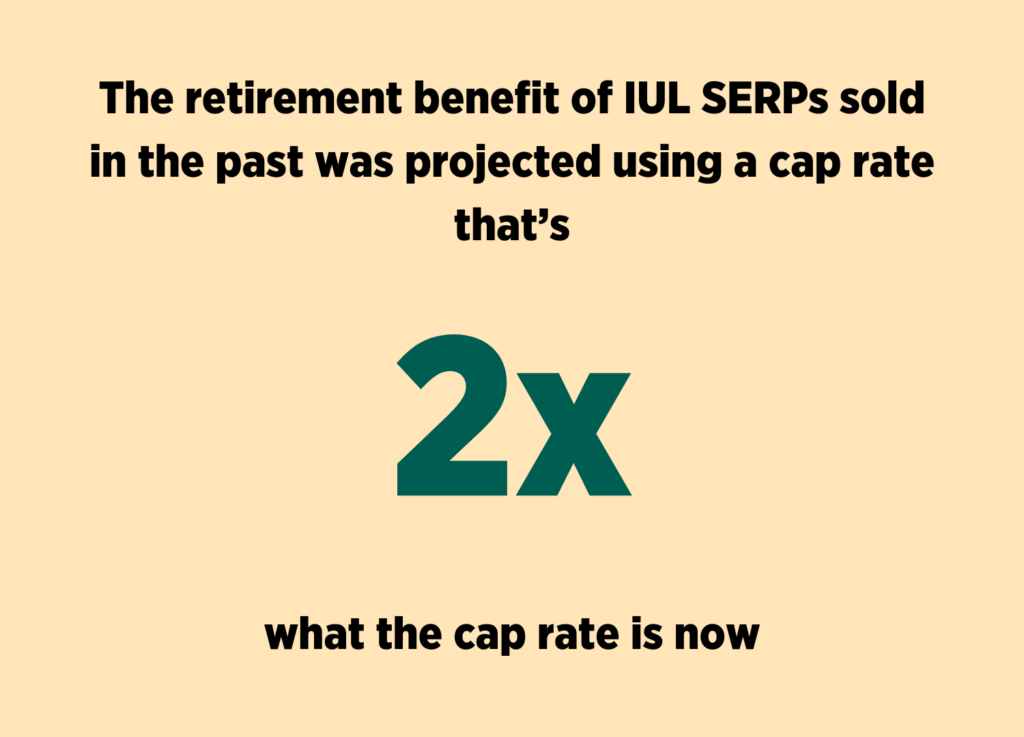

There’s more. The company providing the IUL insurance sets the cap annually—and can change it at any time. In addition, there is no guarantee that the insurance company will set the cap at a particular rate.

Since IULs became popular approximately 15 years ago, caps have been cut in half. The retirement benefit of IUL SERPs sold in the past was projected using a cap rate that’s twice what the cap rate is now. As you might expect, SERPs sold with those much higher caps are now having significant problems paying out as expected under the lower cap now set for them. Executives who hold these policies today face a dramatically reduced retirement benefit.

As an extension of the problem just described, it’s also important to know that virtually all insurance companies treat IUL policies differently depending on when they were sold. To take advantage of the recent rise in interest rates, older policies are being treated worse than newer policies. In effect, you can have different caps based on when the policy was purchased. Older policy: lower cap. Newer policy: higher cap.

Is your head spinning? Jump down to “plan complexity” and go from there.

SIGNIFICANT RISK #2: SEQUENCE OF RETURNS

With an IUL-based split-dollar SERP, returns don’t depend on average market performance—they depend on the sequence of those returns. This is called “sequence of returns risk,” which essentially means your retirement funding can be decimated by timing.

During the accumulation phase (when you’re putting money in), a few bad years don’t significantly reduce your policy’s growth potential. The real danger comes during the distribution phase when the executive is ready to withdraw money for retirement. Each time you borrow from the life insurance policy to create retirement income during a downturn, the policy’s cash value is impacted by borrowing costs and costs of insurance with no offsetting growth in the cash value, creating extreme pressure for retirement funding.

SIGNIFICANT RISK #3: PLAN COMPLEXITY

The ultimate retirement income from an IUL plan will be affected by many more factors—not just sequence of returns risk and caps, but also the cost of insurance and interest, which affect borrowing costs. This complexity makes it difficult to accurately project the plan’s ultimate ability to deliver any particular projected retirement payout, especially when they are compared to SERPs based on the stability of whole life insurance. In all, IUL SERPs carry more risk of the executive getting a bad news letter.

How to Avoid Getting the Bad News Letter About Your SERP

Fortunately, you can significantly reduce the risk of getting a “bad news letter” about your SERP by taking some pretty straightforward steps:

1. Make sure you understand any IUL SERP you’re buying. As a math major with decades of experience in finance and business, I still spend a lot of time understanding what each company is doing with these products.

2. Set up your SERP using whole life insurance. When funded with whole life insurance, the cash value of your split-dollar SERP is guaranteed to increase every year.

3. Consider multiple possible outcomes at the time of retirement. Be sure you understand the range of possibilities you may face with any SERP you’re evaluating. We prefer the predictable returns of whole life-based SERPs. Tools like Life Insurance Sustainability Analysis (LISA), which can run sequence of returns simulations, are among the few that are effective for stress-testing an IUL-based SERP under different market conditions.

4. To get a more realistic view of the potential outcomes for an IUL SERP you already own, give the projected benefit a “haircut” based on the maximum allowed illustrated (projected) crediting rate established by regulation (which is different from the actual crediting rate). Based on our extensive data analysis, the right way to manage sequence of returns risk on an IUL plan is to give the projected benefit a 30% haircut. For example, if the current maximum illustrated crediting rate allowed is 5.7%, design the plan for a 4% illustrated crediting rate. If you happen to be unlucky with sequence of returns risk, you’ve got an appropriate buffer built in.

5. Review your SERP every year to make sure it’s still appropriate for your unique situation. This means making sure your provider is running in-force illustrations (estimates of how a life insurance policy’s cash value balance will change over time) utilizing the current dividend, if using whole life, or the current maximum crediting rate, incorporating the 30% haircut, if you’re using IUL, to reproject your benefit. Does your provider run a current in-force illustration from the insurance company every year? This should be standard practice, and in most cases, required by the split-dollar agreement.

What to Do If You’ve Already Gotten a Bad News Letter About Your SERP

We want every leader to get the retirement funding they have planned for, so we work hard to ensure every plan PARC Street Partners puts in place takes every available precaution against bad news letters. That’s why all of our 250+ SERPs are on target to deliver on their projections, or better, as of this writing.

While we hate hearing that credit union leaders have gotten a bad news letter about their SERP, please contact us if you have. We’ll use our deep knowledge and long experience to help you find a solution if one exists.

This article was originally featured on CUInsight.com

CRN202806-8925047

About the Author

Chris J. Jones, CLU®, ChFC®

Partner & Senior Benefits Consultant

Known for his analytical mindset and mathematical precision, Chris works closely with credit unions to design Supplemental Executive Retirement Plans (SERPs) that are not only durable and compliant but also grounded in data that supports long-term performance. With more than three decades in financial services, he has built a reputation for ensuring that every plan rests on solid numbers and delivers on its promise to executives and boards.

Since 2014, Chris and his team have implemented more than 200 split-dollar SERPs for credit unions and nonprofits, each one on track or exceeding its original performance projections.