Understanding Supplemental Executive Retirement Plans and Long-Term Incentive Plans will help you use them effectively.

In the complex world of executive compensation and talent management, distinguishing between various incentive and retirement plans is critical for boards and credit union executives. In particular, we are seeing confusion in the credit union movement about the differences between Supplemental Executive Retirement Plans (SERPs) and Long-Term Incentive Plans (LTIPs).

The truth is simple: an LTIP is a tool for performance and strategic alignment, whereas a SERP is a tool for building loyalty and retention.[1] Understanding these and other details about the differences between LTIPs and SERPs enables a credit union to use these plans most effectively. The fundamental question to ask is this: Is our goal performance, or is it retention, or both?

LTIP for Performance and SERP for Loyalty

An LTIP is designed to motivate and reward an executive for performance that is “above and beyond” typical expectations. A good one will be intrinsically tied to organizational outcomes, strategic alignment, and the execution of significant multi-year goals.

LTIPs are typically set up to pay out a lump sum of cash to an executive who delivers on key goals within three to five years. They’re a great performance tool for when your credit union is looking to grow or transform.

Examples of goals that call for an LTIP include:

- Leading a post-merger integration, bringing two credit unions into one seamless, successful organization.

- Achieving a full, successful core system conversion.

- Meeting specific, challenging financial performance metrics over a three- to five-year window.

An LTIP pays out when goals are achieved as determined by preset financial metrics, milestones, or key project completion. Boards typically build in some leeway to pay or not pay based on whether the final outcomes under the plan reflect a high level of performance or are more the impact of market conditions.

An LTIP is not effective as a retention tool. Its purpose is to put wind in the sails—to motivate top performance for the timeframe built into the plan.

In contrast, a Supplemental Executive Retirement Plan (SERP), such as a split dollar or a 457(f) SERP geared to retirement, is a career retention and loyalty tool. It is designed to keep a key executive, often the CEO, with the organization until retirement or a specified vesting date.

Whereas LTIPs reward performance outcomes, SERPs reward loyalty and tenure. SERPs are an anchor for your credit union—a mechanism that stabilizes a key executive and ensures their continuous service to your organization.

A Critical Tax Distinction: Why Structure Matters

One of the most significant differences between these plans is the tax implications associated with each.

For executives earning more than $1 million, a traditional LTIP structure, as a cash-based incentive, may subject the executive and a state-chartered credit union to the 21% excise tax on excess compensation as updated by the One Big Beautiful Bill Act (OBBB) of 2025. Federally chartered credit unions are exempt from this tax, which applies to:

- Remuneration paid to a covered employee greater than $1 million. (This includes amounts that vest under a 457(f) SERP).

- Any excess parachute payment to a covered employee.

This potential tax burden on the credit union makes a strong case for retaining your key executive using a “loan regime” collateral assignment split-dollar SERP.

Unlike vested funds in a 457(f) plan or the cash payout of an LTIP, no part of a split dollar SERP taxed under the “loan regime” rules is treated as compensation. Instead, the plan is ultimately structured as a recoverable, interest-bearing loan to the executive that is repaid to the credit union. The executive’s retirement benefits are accessed through tax-favorable life insurance policy distributions. This unique structure allows the plan to avoid excise tax exposure and preserves the credit union’s long-term balance sheet strength.

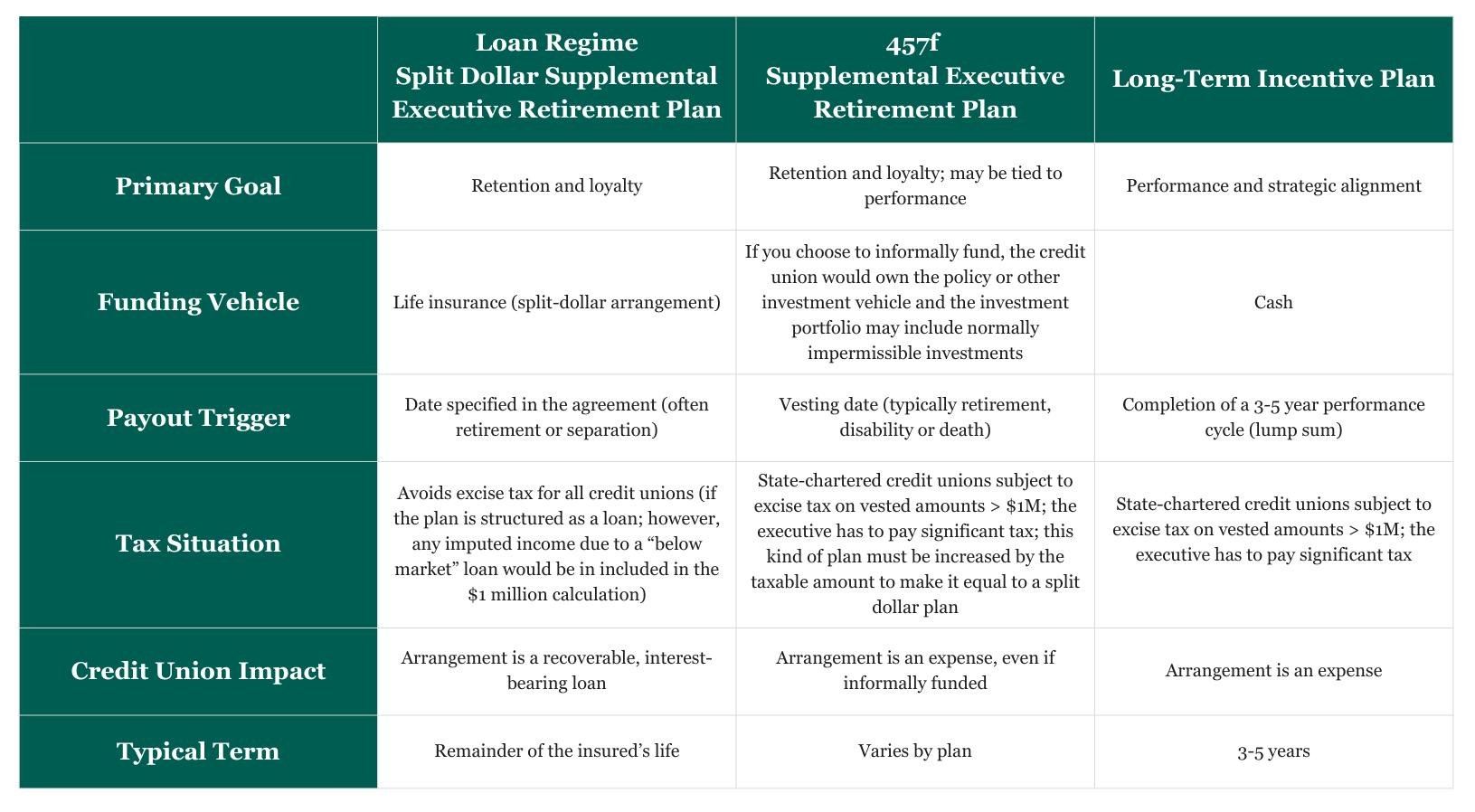

Comparison Chart: Split Dollar SERP vs. 457f SERP vs. LTIP

Should We Implement an LTIP? A SERP? Both?

Sometimes, a credit union board will find that an LTIP is what is needed. Other times, a SERP will be preferable. And sometimes both will be used. The decision really depends on the executive in question and the unique situation of the particular credit union.

To help you think about this, consider these cases, but remember that there are an infinite number of possible scenarios:

1. If an executive is being recruited from the market and has a proven track record, it is common practice to include language in the offer letter that implementing a SERP will begin in 18 to 24 months. This is often necessary to provide a competitive offer.

2. When promoting an internal candidate, such as a CFO to CEO, the board might use an LTIP to motivate top performance in the first two years, then initiate a SERP conversation

3. The board of a credit union that’s going through a merger is promoting a CFO to CEO in a highly competitive market. A SERP is put in place to build loyalty and ensure retention. At the same time, an LTIP is set up to motivate top performance through a merger.

In several recent situations, we’ve seen credit unions blend these tools in a way that mirrors what financial services and fintech firms often do: tie together performance rewards and long-term wealth creation.

The idea is to use a portion, say 25% or 50%, of the LTIP’s projected future value as a down payment on the executive’s long-term retirement planning. The SERP benefit is then discounted by the same amount, essentially treating the LTIP as a component of the credit union’s overall retirement offering.

An important part of this structure is what happens if the LTIP is not earned. In that case, the portion expected to offset the SERP never materializes, and the resulting reduction in the SERP benefit becomes a performance-based adjustment. It creates a natural mechanism that ties long-term retirement value back to multi-year results without adding complexity. This combination can give boards a balanced way to reinforce both performance and retention while also providing executives with a long-term benefit structure that feels comparable to what they might receive in the broader financial sector.

The core message for credit union boards is clear: LTIPs and SERPs serve distinct, yet complementary goals. The LTIP is an engine for transformation, driving executives toward defined, multi-year performance milestones. A SERP is an organizational anchor, securing the continuous service of key leadership for the long haul. Split dollar SERPs in particular offer significant tax-efficiency benefits.

By understanding how the two kinds of plans are different and how they can be used together, boards can gain the clarity to deploy these plans with purpose. PARC Street Group has extensive expertise with the strategic design of both LTIPs and SERPs. If you’d like help evaluating your situation and the available options, please reach out.

The Bottom Line

Footnotes

[1] From a legal standpoint, both a SERP and an LTIP may be treated as non-qualified deferred compensation and would be subject to Section 409A of the Internal Revenue Code. Any such agreement should be reviewed to ensure compliance with Section 409A to avoid unwanted income tax consequences for the executive.

This article was originally featured on CUInsight.com

CRN202901-9981076

About the Authors

Senior Compensation Consultant

J.P. helps credit unions build compensation strategies that align with organizational goals and support long-term success. He works directly with CEOs and boards to ensure pay decisions are transparent, data-driven, and designed to strengthen leadership retention.

With years of experience in compensation consulting, J.P. has guided organizations through complex pay challenges with a focus on fairness and strategic outcomes.

Executive Benefits Consultant & Partner

Kirk Kordeleski, CCE, Executive Benefits Consultant & Partner in PARC Street Group, works with credit unions to design Supplemental Executive Retirement Plans (SERPs) that are durable, customized, and aligned with the unique needs of executive teams.

Drawing on his background as a former credit union CEO, Kirk brings a client’s perspective to every engagement, helping boards and executives build benefit solutions that truly support leadership retention and succession planning. With more than 40 years of experience in the credit union industry, he combines firsthand leadership knowledge with technical expertise to deliver results that strengthen institutions for the long term.